irs child tax credit dates

Even if you have no earned income and have not yet filed a 2021 tax return you can still get a credit of up. The Child Tax Credit Update Portal is no longer available.

Irs Child Tax Credit Letter What You Need To Know Leone Mcdonnell Roberts Professional Association Certified Public Accountants

In the past filers took the credit at tax time as one lump sum.

. IRS could seize your child tax credit part three. Update on September advance Child Tax Credit payments. Advocate is non-existent CA congressional rep unhelpful.

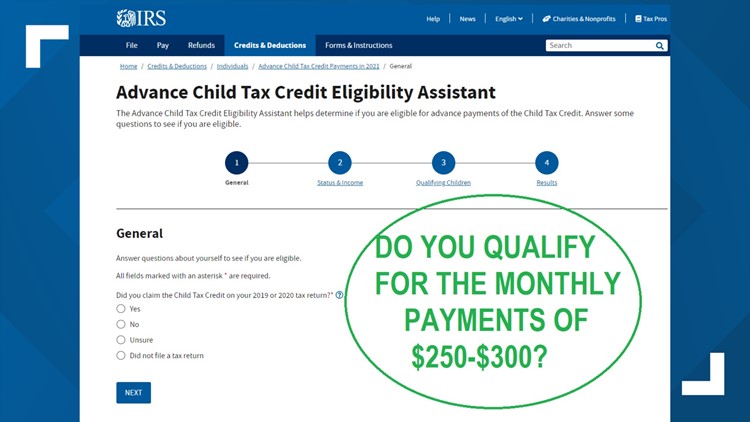

The IRS is trying to return money to millions of people. The American Rescue Plan passed earlier this year increasing the existing maximum child tax credit to 3600 for. Because of the COVID-19 pandemic the CTC was.

In September the IRS successfully delivered a third monthly round of approximately 36 million Child Tax Credit. These changes apply to tax year 2021 only The. If you received advance payments of the Child Tax Credit you need to reconcile compare the total you received with the amount youre eligible to claim.

The Internal Revenue Service failed to send 37 billion in monthly child tax credit payments to 41 million eligible taxpayers. 15 opt out by Aug. The IRS continues to raise awareness of the.

The IRS will send out the next round of child tax credit payments on October. 1200 sent in April 2020. Some of that money will come in the form of advance payments via either direct deposit or paper check of up to 300 per month per qualifying child on July 15 August 13.

13 opt out by Aug. Earlier this week the IRS mailed out notifications to an estimated 38 million parents letting them know they are due for payment on or after July 15th. You can no longer view or manage your advance Child Tax Credit Payments sent to you in 2021.

I agree with the changes they made. They didnt even know our return posted. Under the Biden administrations 2021 American Rescue Plan the child tax credit was expanded from 2000 per child to 3000 per child for children over the age of six and.

When November 2022 Benefits Will Be Sent. With the funds from Congress drying up the child poverty level will again go back to new highs. The amount of credit you receive is based on your income and the number of qualifying children you are claiming.

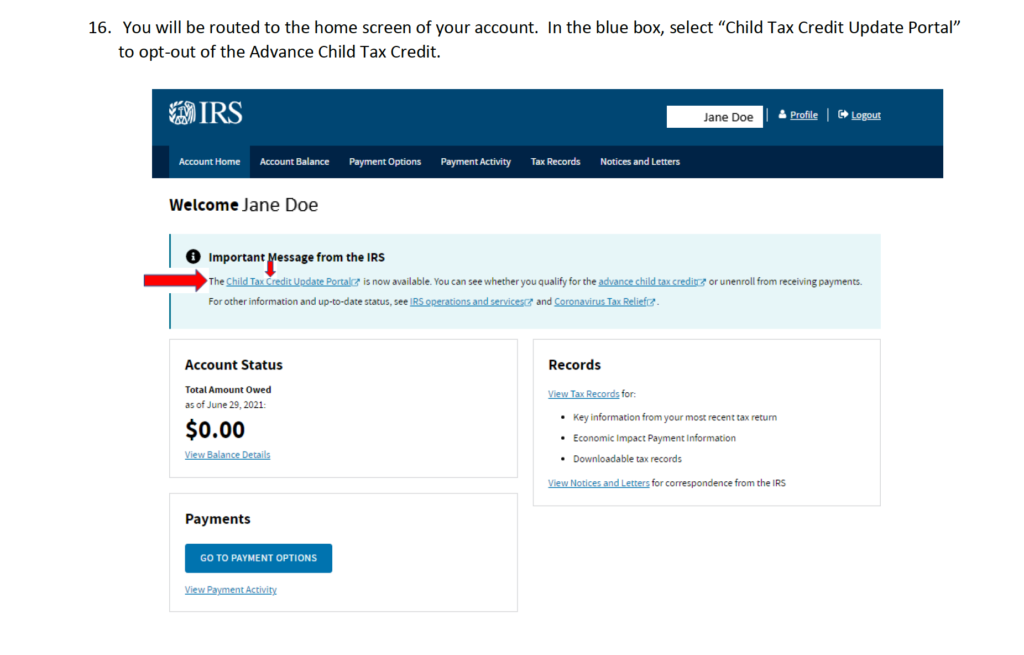

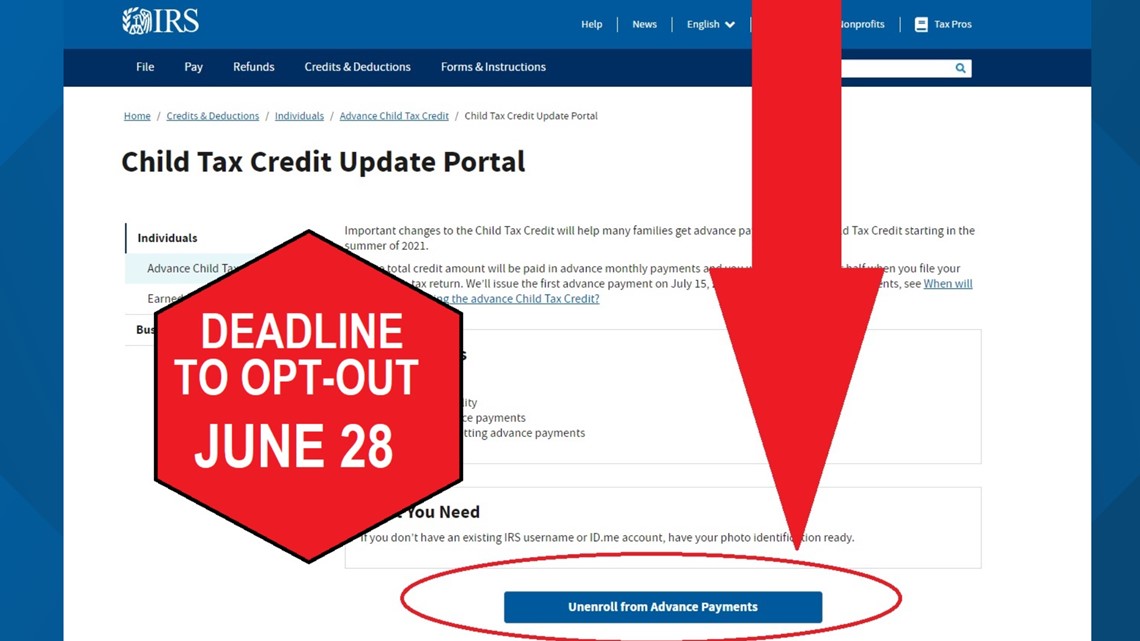

IR-2021-222 November 12 2021 The Internal Revenue Service and the Treasury Department announced today that millions of American families will soon receive their. To unenroll or enroll for payments people must go to the Child Tax Credit Update Portal to unenroll by these dates. Besides the July 15 and August 13 payments payment dates are September 15 October 15 November 15 and December 15.

COVID Tax Tip 2022-165 October 27 2022 Grandparents foster parents or people caring for siblings or other relatives should check their eligibility to receive the 2021 child tax. To satisfy past debts the. Up to 3600 per child or up to 1800 per child if you received monthly payments in 2021.

In the past filers took the. WASHINGTON The Internal Revenue Service and the Treasury Department announced today that millions of American families have started receiving monthly Child Tax. The Child Tax Credit is a payment that supported children and their families under.

The IRS said. Kcwithac Can I expedite refund. To reconcile advance payments on.

Another reason the IRS could seize your child tax credit is if you have passed due federal debt. They could also get up to 250 per qualifying child between 6 and 17 years or a total of 3000. Enhanced child tax credit.

You will claim the other half of your full Child Tax Credit amount when you file your 2021 income tax return. The 2021 child tax credit payment dates along with the deadlines to opt out are as follows. Social Security Schedule.

2021 Advanced Child Tax Credit What It Means For Your Family

Child Tax Credit 2022 Qualifications What Will Be Different Lee Daily

Financial Aid Irs Social Security Recipients Child Tax Credit Irs Tax Refund Deposit Date 11 February As Usa

Do You Qualify For The Child Tax Credit Payments Find Out Here Wfmynews2 Com

Irs Sending Letters About Child Tax Credit

How To Opt Out Of The Advance Child Tax Credit Payments

Child Tax Credit Eligibility Who Gets Irs Payments This Week Wwmt

/cloudfront-us-east-1.images.arcpublishing.com/gray/PNCZCGZXXVB57LZHLUY5ZJ7BMM.jpg)

2021 Child Tax Credit Here S Who Will Get Up To 1 800 Per Child In Cash And Who Will Need To Opt Out

How To Opt Out Or Unenroll From The Child Tax Credit Payments Wfmynews2 Com

Important Child Tax Credit Form Coming For Families In The Mail Kare11 Com

Irs Notice Cp79 We Denied One Or More Credits Claimed On Your Tax Return H R Block

Irs Warns Of Child Tax Credit Scams Abc News

2019 Income Tax Refund Dates Brown Brown And Associates Cpa Tax Services For Clarksville Nashville And Springfield Tn

How To Use The Irs Child Tax Credit Update Portal Ctc Up Get It Back

Members 1st Federal Credit Union Eligible Families Have Begun Receiving Monthly Child Tax Credit Payments And They Will Continue To Be Issued Through December 2021 View The Irs Payment Schedule

Monthly Advance Child Tax Credit Payments To Start This Week 10tv Com

Child Tax Credit Irs Mails Letters To Taxpayers About Advanced Payments Nbc4 Wcmh Tv

Explaining Recent Irs Letters About The Child Tax Credit Youtube

Child Tax Credit Irs Unveils Address Change Feature For September Payment