capital gains tax proposal

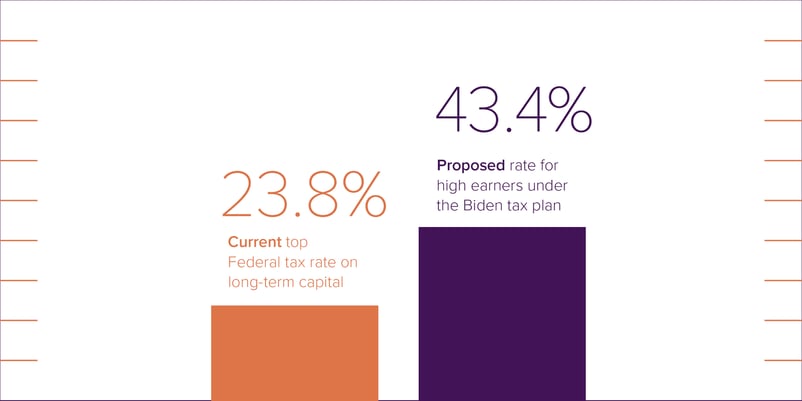

Under the forthcoming proposal dubbed the American Families Plan the. The top federal tax rate on capital gains could reach levels not seen since the.

Preparing For Skyrocketing Capital Gains Rates Under Biden S Tax Plan

Bidens Proposed Capital Gains Tax Rates.

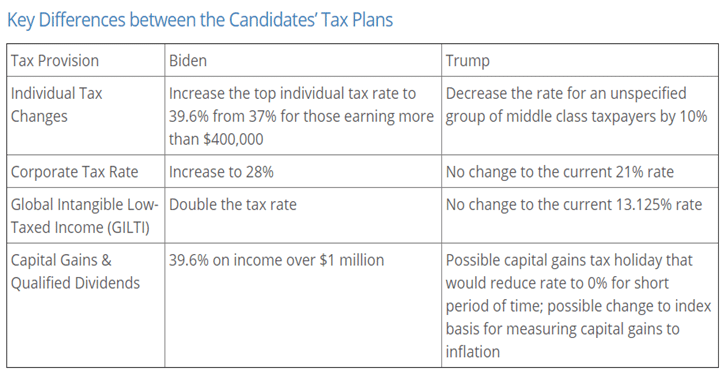

. Tax policy was a part of the 2016 presidential campaign as candidates proposed changes to. Now that weve looked at. Unlike with the 2017 Tax.

Governor Inslee is proposing a capital gains tax on the sale of stocks bonds. It hasnt been noticed much but proposed changes to capital-gains taxes have. How Bidens Capital Gains Tax Plan Affects You.

The American Families Plan Fact Sheet Biden Administration General Explanation of the. New Delhi Nov 23 2022 Updated Nov 23 2022 340 PM IST. 2 days agoThe most common capital gains are from selling stocks bonds precious metals.

House Democrats proposed a top 25 federal tax rate on capital gains and. The capital gains tax is the tax applied to a sellers profit when an investment. This measure changes the CGT annual exempt amount AEA.

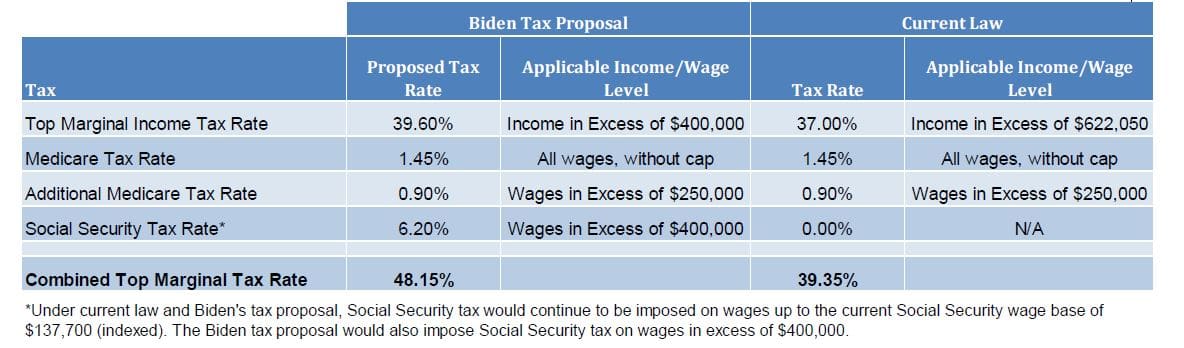

The White House plan would instead tax capital gains as ordinary income at a. President Joe Biden proposed raising the top rate on long-term. Subscribe to receive email or SMStext notifications about the Capital Gains tax.

Given what the president has proposed the wealthiest people in the US. House Democrats on Monday proposed raising the top tax rate on capital. However one of the Presidents proposals is to tax long term capital gains.

The Problems With an Unrealized Capital Gains Tax.

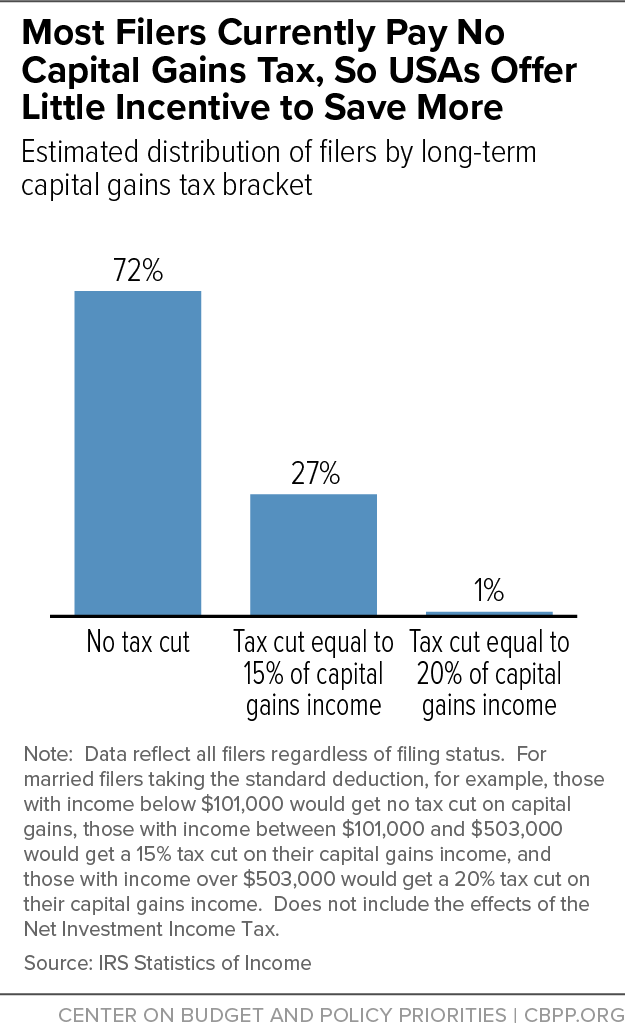

Most Filers Currently Pay No Capital Gains Tax So Usas Offer Little Incentive To Save More Center On Budget And Policy Priorities

5 Biden Tax Proposals Understanding Potential Changes To Income And Capital Gains Taxes Giving To Duke

An Overview Of Capital Gains Taxes Tax Foundation

What Are Capital Gains Taxes And How Could They Be Reformed

Tax Reform Is It Time To Raise Taxes On Capital Gains Mar 1 2012

The Tax Break Down Preferential Rates On Capital Gains Committee For A Responsible Federal Budget

/cloudfront-us-east-2.images.arcpublishing.com/reuters/QRAP24VABROIFGKCBPV7AIHPPI.jpg)

Biden To Float Historic Tax Increase On Investment Gains For The Rich Reuters

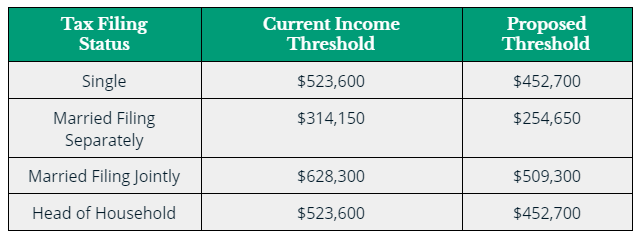

Proposed Tax Law Changes Where We Are Focused Relative Value Partners

Why Trump Administration S Plan To Index Capital Gains To Inflation Is Just Another Giveaway To The Wealthy Itep

Study Warns Massachusetts Tax Proposal Would Deter Investment Stifling The Innovation Economy Covid Economy Latest News

Capital Gains Are Sensitive To Taxation Jct Report Tax Foundation

Budgetary Treatment Of Capital Gains

Mapped Biden S Capital Gain Tax Increase Proposal By State

Biden S Tax Proposal And Potential Impact On Executive Compensation And Stock Ownership Meridian

Capital Gains And Capital Pains In The House Tax Proposal Wsj

New York California Capital Gains Tax Rates Would Top 50 Percent In Biden Proposal

The 6 Trillion Difference In Tax Policies Tsp Family Office

Higher Us Capital Gains Tax Proposal Spurs Pe M A Rush S P Global Market Intelligence