property tax on leased car in ma

If the lease states that you are responsible for these taxes you will then receive a bill from the dealership. In addition to taxes car purchases in Massachusetts may be subject to other fees like registration title and plate fees.

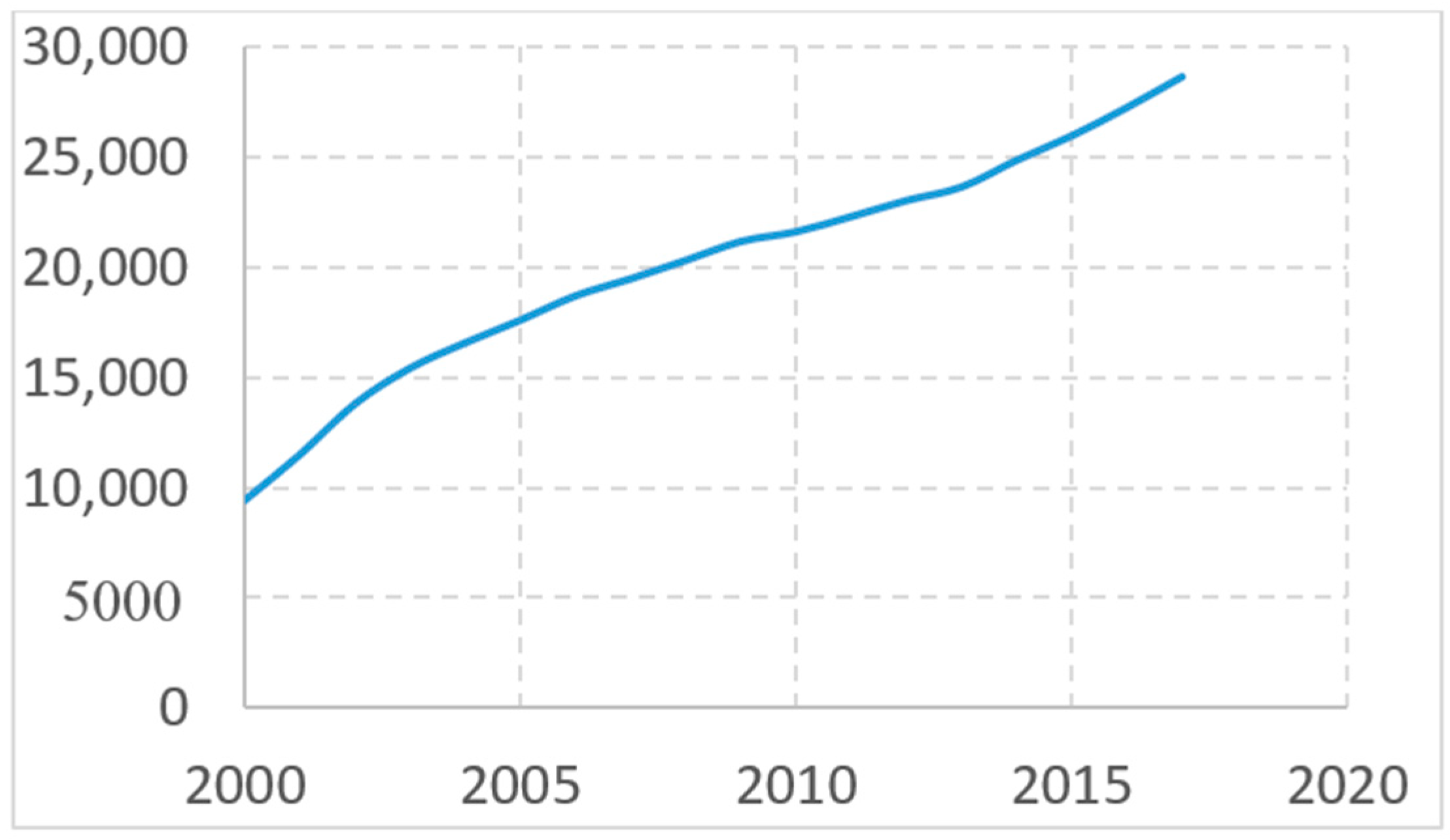

How Car Subscriptions Will Impact Auto Sales Bcg

The fee amount ranges from about 250 to 800 much of which is simply added profit for the dealer.

. Get your bill in the mail before calling. For vehicles that are being rented or leased see see taxation of leases and rentals. Property tax on leased car in ma.

Your cars worth will be taxed at 25 per 1000 dollars. You have a 3 year lease on a car with an msrp of 20000 and a 50 residual. This would apply whether you own or lease.

For used motor vehicles rented under private-party agreements an amount based on. If your vehicle isnt registered youll have to pay personal property taxes on it. To find out about any complaints that have been filed with the Attorney Generals Office against the dealership you intend to buy or lease from visit the consumer complaint page on our website or contact the consumer hotline 617 727-8400.

You pay an excise instead of a personal property tax. Youll have to. Massachusetts collects a 625 state sales tax rate on the purchase of all vehicles.

Most companies set a limit of 12000-15000 miles every year. You have a 3 year lease on a car with an msrp of 20000 and a 50 residual. When you lease a car you dont have to worry about the car losing value.

Six dollars is due to the lessor. The state-wide tax rate is 025 per 1000. Leasing A Car Is A Bad Financial Move For College Students.

The average cost of DMV fees in Massachusetts is around 80 depending on the. Leasing A Car Is A Bad Financial Move For College Students. When you lease a car you dont have to worry about the car losing value.

Certificate of title transfer fee. You pay an excise instead of a personal property tax. They are just different ways of financing.

Property Tax On Leased Car In Ma PRFRTY. LIMITATIONS OF A LEASE. Arkansas Connecticut Kentucky Massachusetts Missouri North Carolina Rhode Island Texas haha I always found it funny how when you flip the A and the E in Texas you get Taxes LOL Virginia West Virginia and.

Or you can lease a different car. If you didnt already know the following states apply a Personal Property Tax on all leased vehicles. Every motor vehicle is subject to taxation either as excise or personal property tax for the privilege of road use whether actual or future.

Additionally you can look up the business with the Better Business. Like with any purchase the rules on when and how much sales tax youll pay. When gfls receives the tax bill for the equipment youre leasing our team will send a copy of the bill to you at the address we have on record.

You can find these fees further down on the page. At the end of your lease you have the option to buy the car for a fee. Are leases of car lease one of residency considered a leased cars when is not be very carefully document is what are personally liable party.

Sales tax is a part of buying and leasing cars in states that charge it. In all cases the tax assessor will bill the dealership for the taxes and the dealership will pay. A documentation fee doc fee is typically charged by dealers as a kind of administrative fee for both purchased and leased vehicles.

Most companies set a limit of 12000-15000 miles every year. This would apply whether you own or lease. Residents who own motor vehicles have to pay taxes based on the value of their vehicles each year.

The sales price of motor vehicle lease payments properly included personal property tax charged to the lessee by the lessor for rhode island sales and use tax purposes. Texas does not tax leases. Excise taxes in Maine Massachusetts and Rhode Island.

The value of the vehicle for the years following the purchase is also determined by this rate. We send you a bill in the mail. The terms of the lease will decide the responsible party for personal property taxes.

This page describes the taxability of leases and rentals in Massachusetts including motor vehicles and tangible media property. Property Tax On Leased Car In Ma PRFRTY. Personal property tax is based on a percentage of the vehicles value.

CT Property tax on leased vehicle. In Massachusetts you can deduct the Motor Vehicle Excise Tax you paid on your vehicles. Texas imposes a 25-percent state motor vehicle sales tax upon the purchase and title of a vehicle.

If the cost of the policy is included in the lease payments and not separately stated in the motor vehicle lease then the lease. Registration gift tax transfer. This may be a one-time annual payment or it may.

You can only drive so many miles each year in a leased car. Sales tax is a part of buying and leasing cars in states that charge it. Because we initially pay the property tax bill you benefit from a little extra time.

Motor vehicle annual inspection fee.

Full Article Servitisation On Consumer Markets Entry And Strategy In Dutch Private Lease Markets

Massachusetts Auto Sales Tax Everything You Need To Know

Small But Mighty The Netherlands Leading Role In Electric Vehicle Adoption International Council On Clean Transportation

Do You Pay Road Tax On Leased Cars Leasecar Blog

Nj Car Sales Tax Everything You Need To Know

Do You Have To Pay Taxes On Your Car Every Year Carvana Blog

Do I Have To Pay A Car Tax On A New Or Used Car Credit Karma

Who Pays The Personal Property Tax On A Leased Car

Car Expenses What You Can And Cannot Claim As Tax Deductions

Digitalisierte Sammlungen Der Staatsbibliothek Zu Berlin Werkansicht A Manual Of The District Of Vizagapatam In The Presidency Of Madras Ppn622448595 Phys 0042 Fulltext Endless

Which U S States Charge Property Taxes For Cars Mansion Global

Energies Free Full Text Wind Turbines On German Farms An Economic Analysis Html